Lifestyle

Millennial achieves Property Dream on his 21st B’day

The ‘Great Australian Dream’ – many say, has turned more into a nightmare for first home buyers. With climbing median house prices of almost $1mil in Sydney, almost $800k in Melbourne, close to $700k in Canberra and hovering around the half million dollar mark across the remaining metro cities – the aspiring dream of property ownership has largely dwindled for young people these days.

The ‘Great Australian Dream’ – many say, has turned more into a nightmare for first home buyers. With climbing median house prices of almost $1mil in Sydney, almost $800k in Melbourne, close to $700k in Canberra and hovering around the half million dollar mark across the remaining metro cities – the aspiring dream of property ownership has largely dwindled for young people these days.

So, it is no surprise that most Millennials resign to renting in the face of major barriers to entry into the property market. After all, the median house prices have gone from 2-3 times of the annual disposable income in the 80’s to 6-7 times nowadays moving the goalpost seemingly out of reach.

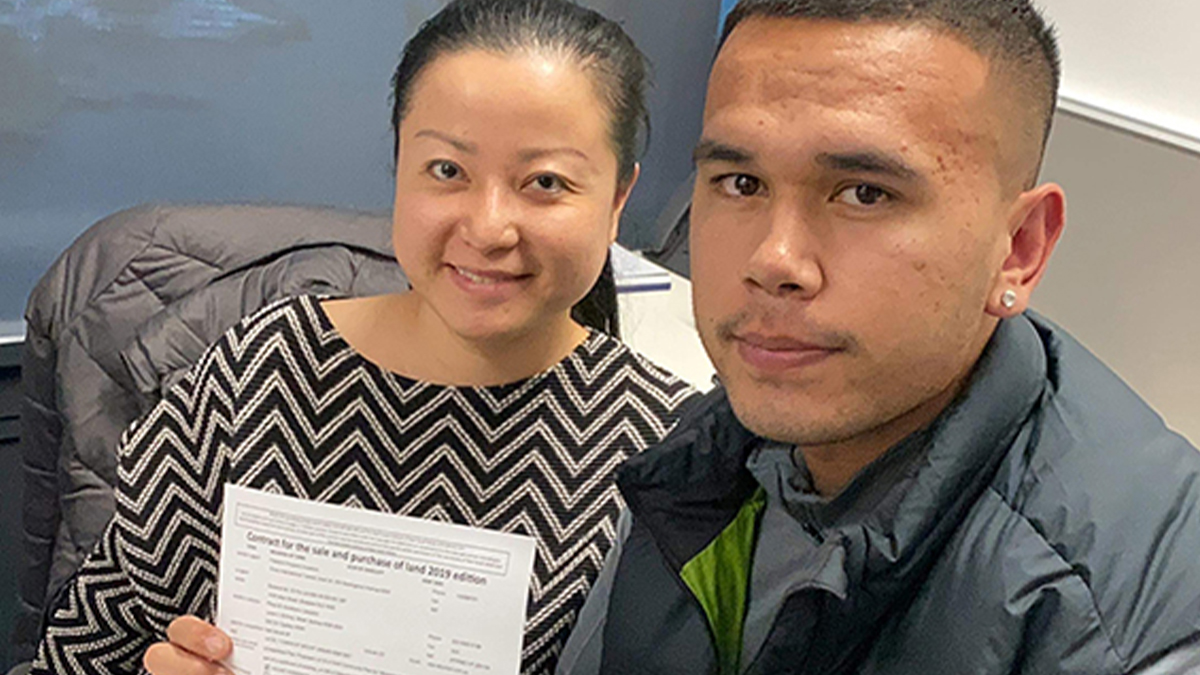

Not so for Kelsey Kuru, who literally on his 21st birthday signed the contracts to buy his first property.

“My dream of owning a property came at the age of 17. I was still in school and had just realised I was not going to make it as a pro NRL player. It shifted my outlook and in seeing other people owning property motivated me to one day also wanting to be a property owner or investor,” says Kelsey.

“Saving was always a problem with me as I faced what every other young adult faces. Such as wanting to stay up to date with the newest technology and latest trends and also going out every weekend”, he says.

Learning about saving and implementing a savings plan or better, a spending habit that actually supports putting money away can be hard these days, especially for younger people who might earn less or are used to having disposable income. Then, Kelsey dropped out of high school in 2016 – in his last year. He started doing labouring jobs across trades like plumbing, civil works, as a sparky’s labourer and worked on swimming pools.

“When I got to around age 19 I started to become strict with my spending and cut down on everything. I would spend money only on things that I needed and not what I wanted. Also, I stopped going out and would stay at home to save money and would only allow myself out for the one-off coffee with friends”, he shares.

He says that learning about property and investing is what got him really focused and played a big part in keeping him determined on getting himself ready to buy a property, both financially and from a knowledge and mindset aspect.

“I guess I was lucky to have had both the inspiration and support from my dad whom I saw turn his own life around using property investing, and from his business partner at Freedom Property Investors, Lianna Pan, who is a very successful investor. She has 25 properties to her name, and she is a property data scientist too. I learned so much from her”.

“I mean we were living in a cramped 2 bedroom apartment; my sister in one room, me and my two brothers in the other and my single dad on the couch in the lounge room. This went on for years. Then something just switched in dad and I saw him go to training courses, seminars and study until late in the night around his job and then he bought his first property. Now he has 17 in just 7 years”, he explains.

When I started to learn more about wealth I understood quickly that property is 100% the vehicle to take me to a better financial position, that’s when I decided that I was willing to have less now so I could afford to buy a property”.

Kelsey started helping at Freedom Property Investors over the past couple of years and that is where he learned a lot from the seminars and what Lianna and Scott Kuru (Kelsey’s dad) talked about every day.

“I learned so much from mentoring and also first-hand experience, lots of youtube videos and from a lot of the other mentors I follow on social media. And, all of them would say the same thing, which is that saving my way to financial freedom was not possible and that property is the number one asset in the world. It just helped me to get really focused and determined to achieve my goal”, he says.

“The biggest lesson I learned was self-discipline. Being able to control myself with spending and staying committed to putting together a deposit. It taught me a lot about myself and makes me want to share this with my friends and family too”, the 21-year-old says.

Kelsey bought a 3-bedroom, two bathroom terrace in the Montaine development at Mount Annan off the plan for $650 000. He had saved the $32 500 deposit, and due to the unique buying scope negotiated through Freedom Property Investors and qualifying for all the grants, meant he could get in on a 5% deposit.

“We negotiated the lower deposit and the builder’s rebate because we had a few buyers ready to move on this development, which is not normally available and off-the-plan is usually a 10% deposit too”, says Lianna Pan, co-founder of Freedom Property Investors.

This means Kelsey makes use of the first home buyers incentives, the $25 000 home builders grant and the $10 000 builders rebate, plus full stamp duty exemption. That totaled a saving of $70 000 in grants and incentives, which will apply on settlement.

The property he bought is part of a new development in Sydney’s South-West, and is close to shops and eateries, public transport and growing infrastructure. It is an area that enjoys a thriving community and is set to have strong rental demand if he ever wanted to rent it out later down the track and is likely to enjoy good capital growth over the coming years.

“I’ve been given a lot of financial advice to be able to save for a deposit which has benefited me greatly. Without the key mentors in my life constantly teaching me I don’t think this would have been possible”.

Kelsey did not just pick something to buy hap-hazarly, but due to his own research, and the mentoring and having access to some of Australia’s leading property investing experts meant that his purchase was calculated and based on data, rather than wishful thinking, a glossy brochure or property appeal alone.

“My advice to young millennials would be to really consider who you are spending your time with and also what you are spending your money on. A lot of the time we are spending money on stuff that we really do not need just to impress people we don’t know. Hanging around the wrong people led me off my plans as I would want to save etc and would be influenced to do stuff that does not fit these goals.

“Once I surrounded myself with people with the same goals, my entire life changed. I was able to stick to saving and fulfil my goal as the people around me were on the same path and are after the same goals,” he says.

“Growing up as a young islander my dream was of course to play NRL. I never thought about business or creating assets. Until I grew older and learnt what was possible. I learnt all this from my father and other mentors I surrounded myself with. Plus being part of a community of budding property owners is so supportive and empowering. I became super aware that I was not good enough for the NRL so I had to come up with a new dream and I am stoked that I have achieved it on my 21st birthday.

“This is so empowering, I mean who would have thought this would happen when I dropped out of school, right”.

Preneur Magazine is a digital publication covering insight, inspiration and innovation and an online community for entrepreneurs, business owners, start-ups and anyone interested in business, entrepreneurship and enterprise.